Estate Planning Software Pricing & Details

The time for easy, convenient, and affordable Estate Planning has arrived!

Next Generation Estate Planning

For Modern Lives

We understand this could be new information for you. Please find a detailed

description of what comes with your comprehensive estate plan below.

Revocable Living Trust

The Revocable Living Trust is the centerpiece of your Estate Planning Portfolio.

The trust is completely under your control. As the name implies, your trust is fully revocable while you are alive. You may alter, amend (in whole or in part), or even revoke your trust at any time. You can transfer your assets back out of your trust just as easily as you can transfer your assets into your Trust.

The person who manages the Trust is called the Trustee (in most cases you are the Trustee initially). After your passing, the successor Trustee you appointed can manage and distribute assets to the beneficiaries of the Trust.

If you have children (even grown kids) you have the option of creating a sub-trust to hold their assets until they reach a certain age or split distributions over time at three different ages. This prevents a potentially immature young adult from receiving a windfall that might cause more damage than good. You can even allow early withdrawal for educational expenses, first home, wedding or even a business.

You can even stipulate certain beneficiaries as "income only", and prevent them from getting a "lump sum" distribution and allow them only to draw and income for education, maintenance and support.

Durable Powers of Attorney

"Durable" means that the appointment of the power will "endure" even after your incapacitation.

A Power of Attorney will give your appointed agent the power to make certain decisions on your behalf when you are unable to do so.

Durable Financial Power of Attorney

This document appoints an agent(s) to perform financial decisions regarding any assets not funded into your Trust at the time of your legal incapacitation. (For assets already funded into the Trust, the Trustee already has this authority.)

Not only do you get to decide who makes financial decisions on your behalf, you also protect your privacy and save money by avoiding expensive court and legal fees.

Having a Durable Financial Power of Attorney will help help avoid a court-supervised guardianship/conservatorship in the event of legal incapacitation where all finances become a matter of public record.

Durable Power of Attorney for Healthcare

This document allows your appointed agent(s) to make important health care decisions for you in the event of your incapacitation.

In conjunction with your Living Will, your agent can make all important healthcare decisions, including the continuation of life support systems.

Durable Agent Notice

The Durable Agent Notice serves to notify, in writing "to whom it concern" that your agent has accepted the appointment and will carry out such duties.

Living Will & Advanced Medical Directives

Living Will and Advanced Health Care Directives allow you to determine how you want medical care administered if you have a terminal illness or are in a comatose state.

If such a condition should happen to you, these instruments will serve to give notice to medical professionals your wishes (such as if you desire whether or not to be kept alive by artificial means).

Your Living Will agents are also considered to be the guardian of your person. In most cases, your Advanced Health Care Directive can take the place of a Living Will.

Many healthcare providers require a Durable Power of Attorney for Healthcare in conjunction with a Living Will to carry out the decrees of a Living Will. It is important that your agents for your Durable Power of Attorney for Healthcare are the same as your Living Will. (Both documents are included in your comprehensive estate plan.)

Durable HIPAA Statement

The Durable HIPAA Statement grants an exception to the privacy restrictions of the HIPAA law to allow for personal information to be provided to the Agents you have appointed so they can make an informed decision regarding your medical care.

Last Will & Testament “Pour Over Will”

The Last Will and Testament included in your document set is better described as a "Pour-Over Will". It is used in conjunction with a Revocable Living Trust and its primary function is to convey everything you have forgotten to fund into the trust prior to your death (hence "pour-over").

Please note that unless your remaining assets are minimal in value, all non-trust (un-funded) assets must go through probate first. So be sure to use the Comprehensive Funding Kit to keep your asset funding up-to-date.

Certificate of Trust

The Certificate of Trust is primarily for providing evidence to a transfer agent (brokers, bankers, account managers etc.) about certain facts concerning your trust.

This document helps protect your privacy by not disclosing the full details of your trust when funding assets into your trust.

Guardianship

In addition you may appoint guardians for your minor or disabled adult dependents so you can be assured who will take custody.

Comprehensive Asset Funding Kit

Your Trust is like an empty basket. You must fill this basket with your assets by transferring them into the Trust. This process is called "Funding".

To avoid probate, its vital to fully fund your trust once completed, so we have developed our exclusive Funding Kit to help you through the process of moving your assets into the Trust, (called "Funding the Trust").

The Funding Kit provides detailed instructions on nearly every possible type of asset and how you can fund it into your Trust.

Transmittal Letters (for Funding, Retitlement & Beneficiary Changes)

Our system will generate funding letters for each of your assets for you, just follow the guide.

Retitlement letters can be mailed to respective agencies (transfer agents) for transfer of title.

Beneficiary letters allow you to mail to respective agencies a change of beneficiary of your various assets.

There are other documents also included for other functions.

24/7 access to the Comprehensive Funding Kit: The key is to get organized, and make a list of your assets. Don't worry if you do not have everything ready at once. You can login at any time to continue the process and continue where you left off!

Keep your trust up-to-date at no additional charge. When new assets are sold or acquired; log back in to update your funding. Unlike other solutions there is no "change fees", as long as your account is active you can log in and access all the features.

Personalized Support with Our Concierge Services

Expert Guidance: Navigate the complexities of software implementation with the help of an experienced consultants who understand your needs.

Continuous Support: Benefit from ongoing assistance, ensuring that any questions or issues are promptly addressed throughout the software lifecycle.

Reduce Stress: Alleviate the burden of managing software and configuration on your own, giving you peace of mind.

Maximize Value: Optimize your software's potential by fully leveraging its features and functionalities with the help of our dedicated concierge consultant.

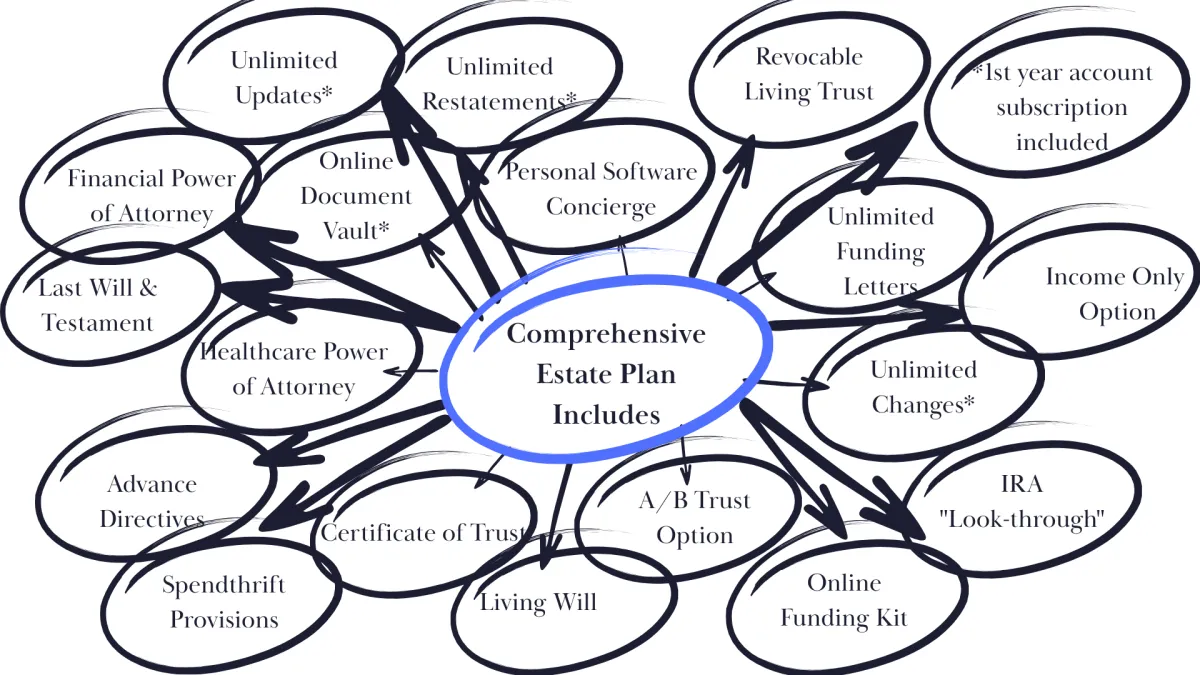

Comprehensive Estate Plan Includes:

Total value: $3,995

Just $2,495.00

***Unlimited access to make changes and restatements with an active account. $29.95 per yr

Data in accounts that have lapsed and are inactive for over a year may be archived and/or deleted.

INcLUDing

Personalized Support

Included With Your Software

Navigating software implementation can be complex, but with our concierge services, you're never alone in the process. Our dedicated team is here to guide you every step of the way, ensuring a seamless and personalized experience.

We help you fill out and configure the software to meet your specific needs, providing expert support and answering any questions you may have. From initial setup to ongoing customization, our concierge services are designed to take the stress out of software adoption, so you can focus on what matters most—your family.

Seamless Software Setup with Our Concierge Services

Expert Guidance

Fully customizable, attorney drafted plan at your fingertips. No waiting, no travel, no big lawyer bills!

Rather than having to take your time and be inconvenienced to visit with an attorney face to face, through the power of the internet and technology our experts bring the entire process direct to you via the internet. No waiting, no travel, no big money lawyer bills. Instead you have the convenience to complete the interview on your time and at your leisure. No big legal bill. Software and taking the attorneys time and cost of an office out of the picture enables us to price your comprehensive plan at a small fraction of what you would have to pay otherwise. Plus, you get far more benefits than through the traditional process and all made possible through the power of technology.

TESTIMONIALS

What others are saying

"I have secured what's

most important"

"I am a single mom that worried my kids would be sent to foster homes if something happened. THANK YOU for making this so affordable, now I know my children will be in always be in a good home.

- Tiffany, Arizona

"We honored his wishes"

"My dad planned ahead and got an estate plan. It made things so much easier for the family after he was diagnosed with Alzheimer's. When he finally passed, we knew we were able to honor him as he wished."

- Steve, Virginia

"Highly recommend this"

"Thank you! We would never had our plan completed before my husband's heart attack. It was so easy and simple we were able to get our plan completed in a few hours the day before our vacation. We never would have had time to go to a lawyer and wait for documents."

- Jan, California

Office Locations:

Dayton, OH

Youngstown, OH

***Doing business in all 50 states

Call

Email:

Site: